The Bear Stearns Companies, Inc. was a New York-based worldwide venture bank and securities exchanging and business firm that fizzled in 2008 as a major aspect of the worldwide money related emergency and subsidence and was along these lines sold to JPMorgan Chase. Its principle business ranges before its disappointment were capital markets dealer, riches administration and worldwide clearing administrations.

In the years paving the way to the disappointment, Bear Stearns was vigorously included in securitization and issued a lot of benefit upheld securities, which on account of home loans were spearheaded by Lewis Ranieri, "the father of home loan securities". As financial specialist misfortunes mounted in those business sectors in 2006 and 2007, the organization really expanded its presentation, particularly the home loan sponsored resources that were key to the subprime contract emergency. In March 2008, the Federal Reserve Bank of New York gave a crisis advance to attempt to turn away a sudden breakdown of the organization. The organization couldn't be spared, on the other hand, and was sold to JP Morgan Chase for $10 per offer, a cost far underneath its pre-emergency 52-week high of $133.20 per offer, yet not as low as the $2 per share initially settled upon by Bear Stearns and JP Morgan Chase.

The breakdown of the organization was a prelude to the danger administration emergency of the speculation saving money industry in the United States and somewhere else that built up and finally finished in September 2008, and the resulting worldwide budgetary emergency of 2008â€"2009. In January 2010, JPMorgan stopped utilizing the Bear Stearns name.

History

Bear Stearns Bravo - Play Bear Stearns Bravo: http://www.bearstearnsbravo.com Los Angeles, 2007. The Regulators Franco and Henri have been dispatched to Bear Stearns, ...

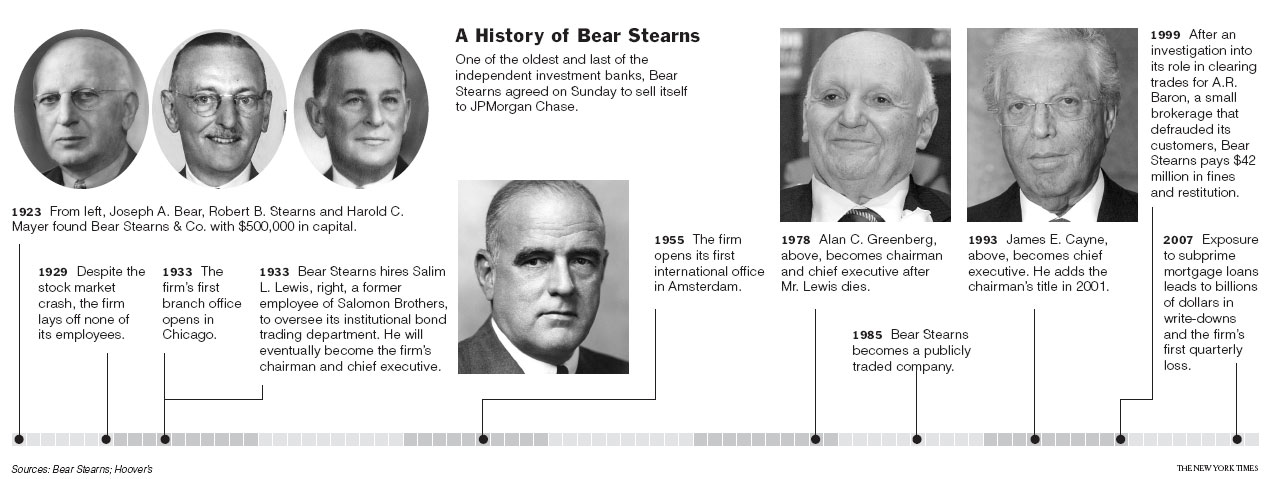

Bear Stearns was established as a value exchanging house on May Day 1923 by Joseph Ainslee Bear, Robert B. Stearns and Harold C. Mayer Sr. with $500,000 in capital. Inside pressures rapidly emerged among the three originators. The firm survived the Wall Street Crash of 1929 without laying off any workers and by 1933 opened its first branch office in Chicago. In 1955, the firm opened its first universal office in Amsterdam.

In 1985, Bear Stearns turned into a traded on an open market organization. It served partnerships, establishments, governments and people. The organization's business included corporate fund, mergers and acquisitions, institutional values, settled wage deals & hazard administration, exchanging and exploration, private customer administrations, subsidiaries, remote trade and fates deals and exchanging, resource administration and guardianship administrations. Through Bear Stearns Securities Corp., it offered worldwide clearing administrations to specialist merchants, prime agent customers and other expert brokers, including securities giving. Bear Stearns was likewise known for a standout amongst the most broadly read market knowledge pieces in the city, known as the "Early Look at the Market."

Bear Stearns' World Headquarters was situated at 383 Madison Avenue, between East 46th Street and East 47th Street in Manhattan. By 2007, the organization utilized more than 15,500 individuals around the world. The firm was headquartered in New York City with workplaces in Atlanta, Boston, Chicago, Dallas, Denver, Houston, Los Angeles, Irvine, San Francisco, St. Louis, Whippany, New Jersey; and San Juan, Puerto Rico. Globally the firm had workplaces in London, Beijing, Dublin, Frankfurt, Hong Kong, Lugano, Milan, Sã£o Paulo, Mumbai, Shanghai, Singapore and Tokyo.

In 2005â€"2007, Bear Stearns was perceived as the "Most Admired" securities firm in Fortune's "America's Most Admired Companies" overview, and second in general in the security firm segment. The yearly study is a prestigious positioning of representative ability, nature of danger administration and business development. This was the second time in three years that Bear Stearns had accomplished this "top" qualification.

Lead-up to the disappointment â€" expanding presentation to subprime contracts

By November, 2006, the organization had all out capital of give or take $66.7 billion and aggregate resources of $350.4 billion and as indicated by the April 2005 issue of Institutional Investor magazine, Bear Stearns was the seventh-biggest securities firm as far as aggregate capital.

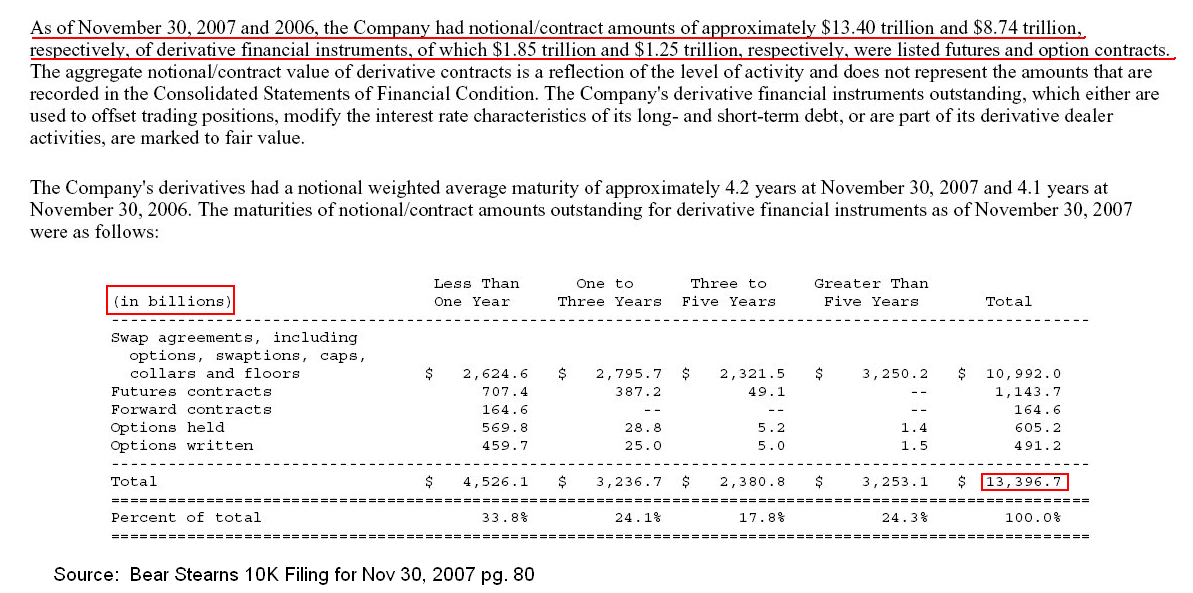

After a year Bear Stearns had notional contract measures of roughly $13.40 trillion in subordinate monetary instruments, of which $1.85 trillion were recorded prospects and alternative contracts. Furthermore, Bear Stearns was conveying more than $28 billion in 'level 3' benefits on its books toward the end of monetary 2007 versus a net value position of just $11.1 billion. This $11.1 billion upheld $395 billion in resources, which implies an influence proportion of 35.6 to 1. This profoundly utilized accounting report, comprising of numerous illiquid and conceivably useless resources, prompted the fast lessening of speculator and moneylender certainty, which at long last vanished as Bear was compelled to call the New York Federal Reserve to fight off the approaching course of counterparty danger which would result from constrained liquidation.

Begin of the emergency â€" two subprime home loan stores fall flat

On June 22, 2007, Bear Stearns promised a collateralized advance of up to $3.2 billion to "rescue" one of its stores, the Bear Stearns High-Grade Structured Credit Fund, while arranging with different banks to advance cash against guarantee to another trust, the Bear Stearns High-Grade Structured Credit Enhanced Leveraged Fund. Bear Stearns had initially set up quite recently $35 million, so they were reluctant about the bailout; in any case, CEO James Cayne and other senior administrators agonized over the harm to the organization's notoriety. The stores were put resources into meagerly exchanged collateralized obligation commitments (CDOs). Merrill Lynch seized $850 million value of the hidden security yet just had the capacity closeout $100 million of them. The occurrence started concern of disease as Bear Stearns may be compelled to sell its CDOs, provoking a discount of comparable resources in different portfolios. Richard A. Marin, a senior official at Bear Stearns Asset Management in charge of the two mutual funds, was supplanted on June 29 by Jeffrey B. Path, a previous Vice Chairman of adversary speculation bank, Lehman Brothers.

Amid the week of July 16, 2007, Bear Stearns revealed that the two subprime mutual funds had lost almost the greater part of their worth in the midst of a quick decrease in the business sector for subprime contracts.

On August 1, 2007, speculators in the two stores made a move against Bear Stearns and its top board and danger administration chiefs and officers. The law offices of Jake Zamansky & Associates and Rich & Intelisano both documented discretion claims with the National Association of Securities Dealers charging that Bear Stearns misdirected speculators about its introduction to the trusts. This was the first lawful activity made against Bear Stearns. Co-President Warren Spector was requested that leave on August 5, 2007, as an aftereffect of the breakdown of two speculative stock investments fixing to subprime contracts. A September 21 report in the New York Times noticed that Bear Stearns posted a 61 percent drop in net benefits because of their fence investments misfortunes. With Samuel Molinaro's November 15 disclosure that Bear Stearns was recording a further $1.2 billion in home loan related securities and would confront its first misfortune in 83 years, Standard & Poor's minimized the organization's FICO score from AA to A.

Matthew Tannin and Ralph R. Cioffi, both previous chiefs of mutual funds at Bear Stearns Companies, were captured June 19, 2008. They confronted criminal charges and were found not liable of misdirecting speculators about the dangers included in the subprime market. Tannin and Cioffi have additionally been named in claims delivered by Barclays Bank, who claims they were one of the numerous financial specialists deceived by the officials.

They were likewise named in common claims acquired 2007 by financial specialists, including Barclays Bank, who guaranteed they had been misdirected. Barclays asserted that Bear Stearns realized that certain benefits in the Bear Stearns High-Grade Structured Credit Strategies Enhanced Leverage Master Fund were worth a great deal not exactly their declared qualities. The suit asserted that Bear Stearns chiefs formulated "an arrangement to profit for themselves and further to utilize the Enhanced Fund as a store for dangerous, low quality speculations." The claim said Bear Stearns told Barclays that the improved trust was up just about 6% through June 2007â€"when "actually, the portfolio's advantage qualities were falling."

Different financial specialists in the store included Jeffrey E. Epstein's Financi

Sustained bailout and deal to JPMorgan Chase

On March 14, 2008, the Federal Reserve Bank of New York consented to give a $25 billion credit to Bear Stearns collateralized by without a worry in the world resources from Bear Stearns keeping in mind the end goal to give Bear Stearns the liquidity to up to 28 days that the business was declining to give. Evidently the Federal Reserve Bank of New York had a change of heart and told Bear Stearns that the 28 day advance was occupied to them. The arrangement was then changed to where the NY FED would make an organization to purchase $30 billion value of Bear Stearns resources. After two days, on March 16, 2008, Bear Stearns consented to a merger arrangement with JP Morgan Chase in a stock swap worth $2 an offer or under 7 percent of Bear Stearns' fairly estimated worth only two days prior. This deal cost spoke to a stunning misfortune as its stock had exchanged at $172 an offer as late as January 2007, and $93 an offer as late as February 2008. The new organization is supported by credits of $29 billion from the New York FRB, and $1 billion from JP Morgan Chase (the lesser advance), with no further plan of action to JP Morgan Chase. This non-response credit implies that the advance is collateralized by home loan obligation and that the administration can't seize JP Morgan Chase's benefits if the home loan obligation guarantee gets to be inadequate to reimburse the advance. Administrator of the Fed, Ben Bernanke, protected the bailout by expressing that a Bear Stearns' liquidation would have influenced the genuine economy and could have brought on a "disordered loosening up" of ventures over the US advertises.

On March 20, Securities and Exchange Commission Chairman Christopher Cox said the breakdown of Bear Stearns was because of an absence of certainty, not an absence of capital. Cox noticed that Bear Stearns' issues raised when bits of gossip spread about its liquidity emergency which thusly disintegrated financial specialist trust in the firm. "Despite that Bear Stearns kept on having astounding guarantee to give as security to borrowings, market counterparties turned out to be less eager to go into collateralized subsidizing game plans with Bear Stearns," said Cox. Bear Stearns' liquidity pool began at $18.1 billion on March 10 and afterward dove to $2 billion on March 13. Eventually market bits of gossip about Bear Stearns' troubles got to be self-satisfying, Cox said.

On March 24, 2008, a class activity was documented for the benefit of shareholders, testing the terms of JPMorgan’s as of late declared securing of Bear Stearns. That same day, another assention was come to that raised JPMorgan Chase's offer to $10 an offer, up from the beginning $2 offer, which implied an offer of $1.2 billion. The amended arrangement was intended to calm miracle speculators and any consequent lawful activity brought against JP Morgan Chase as an aftereffect of the arrangement and additionally to avoid representatives, a large portion of whose past remuneration comprised of Bear Stearns stock, from leaving for different firms. The Bear Stearns bailout was seen as a compelling case situation, and keeps on bringing up noteworthy issues about Fed intercession. On April 8, 2008, Paul A. Volcker expressed that the Fed has taken 'activities that stretch out to the very edge of its legitimate and suggested forces.' See his comments at a Luncheon of the Economic Club of New York. On May 29, Bear Stearns shareholders endorsed the deal to JPMorgan Chase at the $10-per-offer cost.

An article by writer Matt Taibbi for Rolling Stone battled that exposed short offering had a part in the downfall of both Bear Stearns and Lehman Brothers. A study by fund specialists at the University of Oklahoma Price College of Business mulled over exchanging monetary stocks, including Bear Stearns and Lehman Brothers, and discovered "no proof that stock value decays were brought about by exposed short offering."

Structure before breakdown

Overseeing Partners/Chief Executive Officers

- Salim L. Lewis: 1949â€"1978

- Alan C. Greenberg: 1978â€"1993

- James Cayne: 1993â€"2008

- Alan Schwartz: 2008â€"collapse

Real shareholders

The biggest Bear Stearns shareholders as of December 2007 were:- Dump cart Hanley Mewhinney & Strauss â€" 9.73%

- Joseph C. Lewis â€" 9.36%

- Morgan Stanley â€" 5.37%

- James Cayne â€" 4.94%

- Legg Mason Capital Management â€" 4.84%

- Private Capital Management â€" 4.49%

- Barclays Global Investors â€" 3.10%

- State Street â€" 3.01%

- Vanguard Group â€" 2.67%

- Janus Capital Management â€" 2.34%

See moreover

.

.

that is the number one time I came to this blog and i discovered a few applicable stuff proper right here. essentially I keen to realize new parameters of writing every-time and someday it turn out to be actually very tough to find such type of platform. Administratiekantoor haarlem

ReplyDelete