Online banking (OLB) is an electronic payment system that enables customers of a financial institution to conduct financial transactions on a website operated by the institution, such as a retail bank, virtual bank, credit union or building society. Online banking is also referred as Internet banking, e-banking, virtual banking and by other terms.

To access a financial institution's online banking facility, a customer with Internet access would need to register with the institution for the service, and set up some password (under various names) for customer verification. The password for online banking is normally not the same as for telephone banking. Financial institutions now routinely allocate customers numbers (also under various names), whether or not customers have indicated an intention to access their online banking facility. Customers' numbers are normally not the same as account numbers, because a number of customer accounts can be linked to the one customer number. The customer can link to the customer number any account which the customer controls, which may be cheque, savings, loan, credit card and other accounts. Customer numbers will also not be the same as any debit or credit card issued by the financial institution to the customer.

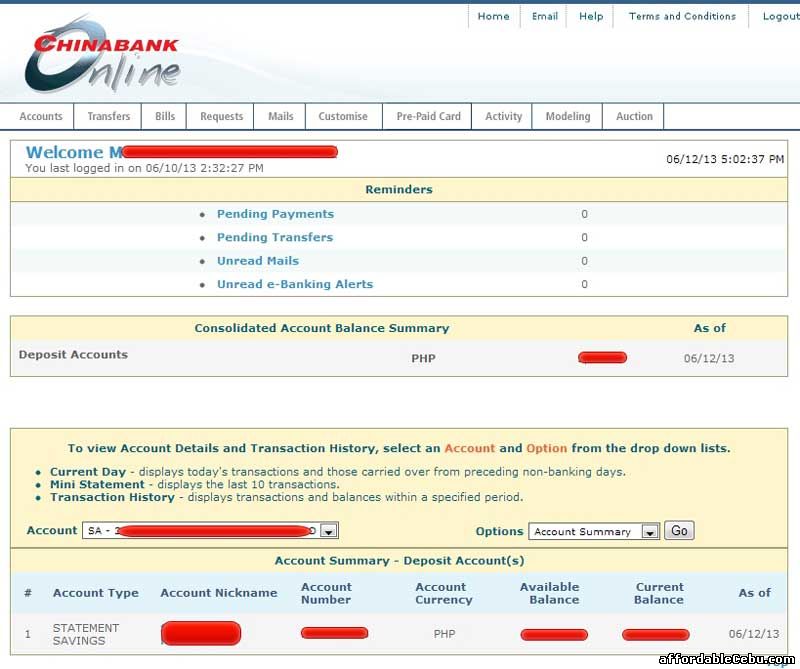

To access online banking, a customer would go to the financial institution's secured website, and enter the online banking facility using the customer number and password previously setup. Some financial institutions have set up additional security steps for access to online banking, but there is no consistency to the approach adopted.

Features

Online banking facilities offered by various financial institutions have many features and capabilities in common, but also have some that are application specific.

The common features fall broadly into several categories:

- A bank customer can perform non-transactional tasks through online banking, including -

- Viewing account balances

- Viewing recent transactions

- Downloading bank statements, for example in PDF format

- Viewing images of paid cheques

- Ordering cheque books

- Download periodic account statements

- Downloading applications for M-banking, E-banking etc.

- Bank customers can transact banking tasks through online banking, including -

- Funds transfers between the customer's linked accounts

- Paying third parties, including bill payments (see, e.g., BPAY) and third party fund transfers(see, e.g., FAST)

- Investment purchase or sale

- Loan applications and transactions, such as repayments of enrollments

- Credit card applications

- Register utility billers and make bill payments

- Financial institution administration

- Management of multiple users having varying levels of authority

- Transaction approval process

Some financial institutions offer unique Internet banking services, for example:

- Personal financial management support, such as importing data into personal accounting software. Some online banking platforms support account aggregation to allow the customers to monitor all of their accounts in one place whether they are with their main bank or with other institutions.

History

The precursor for the modern home online banking services were the distance banking services over electronic media from the early 1980s. The term 'Online' became popular in the late '80s and referred to the use of a terminal, keyboard and TV (or monitor) to access the banking system using a phone line. 'Home banking' can also refer to the use of a numeric keypad to send tones down a phone line with instructions to the bank. Online services started in New York in 1981 when four of the city's major banks (Citibank, Chase Manhattan, Chemical and Manufacturers Hanover) offered home banking services. using the videotex system. Because of the commercial failure of videotex these banking services never became popular except in France where the use of videotex (Minitel) was subsidised by the telecom provider and the UK, where the Prestel system was used. For more information about the latter see Online banking in the U.K..

When the clicks-and-bricks euphoria hit in the late 1990s, many banks began to view Web-based banking as a strategic imperative. The attraction of banks to online banking are fairly obvious: diminished transaction costs, easier integration of services, interactive marketing capabilities, and other benefits that boost customer lists and profit margins. Additionally, Web banking services allow institutions to bundle more services into single packages, thereby luring customers and minimizing overhead.

A mergers-and-acquisitions wave swept the financial industries in the mid-and late 1998s, greatly expanding banks' customer bases. Following this, banks looked to the Web as a way of maintaining their customers and building loyalty. A number of different factors are causing bankers to shift more of their business to the virtual realm.

While financial institutions took steps to implement e-banking services in the mid-1990s, many consumers were hesitant to conduct monetary transactions over the web. It took widespread adoption of electronic commerce, based on trailblazing companies such as America Online, Amazon.com and eBay, to make the idea of paying for items online widespread. By 2000, 80 percent of U.S. banks offered e-banking. Customer use grew slowly. At Bank of America, for example, it took 10 years to acquire 2 million e-banking customers. However, a significant cultural change took place after the Y2K scare ended. In 2001, Bank of America became the first bank to top 3 million online banking customers, more than 20 percent of its customer base. In comparison, larger national institutions, such as Citigroup claimed 2.2 million online relationships globally, while J.P. Morgan Chase estimated it had more than 750,000 online banking customers. Wells Fargo had 2.5 million online banking customers, including small businesses. Online customers proved more loyal and profitable than regular customers. In October 2001, Bank of America customers executed a record 3.1 million electronic bill payments, totaling more than $1 billion. In 2009, a report by Gartner Group estimated that 47 percent of U.S. adults and 30 percent in the United Kingdom bank online.

Today, many banks are internet only banks. Unlike their predecessors, these internet only banks do not maintain brick and mortar bank branches. Instead, they typically differentiate themselves by offering better interest rates and more extensive online banking features.

First online banking services in the United States

According to "Banking and Finance on the Internet," edited by Mary J. Cronin, online banking was first introduced in the early 1980s in New York. Four major banksâ€"Citibank, Chase Manhattan, Chemical and Manufacturers Hanoverâ€"offered home banking services. Chemical introduced its Pronto services for individuals and small businesses in 1983. It allowed individual and small-business clients to maintain electronic checkbook registers, see account balances, and transfer funds between checking and savings accounts. Pronto failed to attract enough customers to break even and was abandoned in 1989. Other banks had a similar experience.

Online banking in the U.K.

Almost simultaneously with the United States, online banking arrived in the United Kingdom. The UK's first home online banking services known as Homelink was set up by Bank of Scotland for customers of the Nottingham Building Society (NBS) in 1983. The system used was based on the UK's Prestel viewlink system and used a computer, such as the BBC Micro, or keyboard (Tandata Td1400) connected to the telephone system and television set. The system allowed on-line viewing of statements, bank transfers and bill payments. In order to make bank transfers and bill payments, a written instruction giving details of the intended recipient had to be sent to the NBS who set the details up on the Homelink system. Typical recipients were gas, electricity and telephone companies and accounts with other banks. Details of payments to be made were input into the NBS system by the account holder via Prestel. A cheque was then sent by NBS to the payee and an advice giving details of the payment was sent to the account holder. BACS was later used to transfer the payment directly.

Stanford Federal Credit Union was the first financial institution to offer online internet banking services to all of its members in October 1994.

Today, many banks are internet only banks. Unlike their predecessors, these internet only banks do not maintain brick and mortar bank branches. Instead, they typically differentiate themselves by offering better interest rates and more extensive online banking features.

Banks and the World Wide Web

In the 1990s, banks realized that the rising popularity of the World Wide Web gave them an added opportunity to advertise their services. Initially, they used the Web as another brochure, without interaction with the customer. Early sites featured pictures of the bank's officers or buildings, and provided customers with maps of branches and ATM locations, phone numbers to call for further information and simple listings of products.

Interactive banking on the Web

Wells Fargo was the first U.S. bank to add account services to its website, in 1995. Other banks quickly followed suit. That same year Presidential became the first bank in the United States to open bank accounts over the Internet. According to research by Online Banking Report, by the end of 1999, less than 0.4% of households in the U.S. were using online banking. At the beginning of 2004, some 33 million U.S. households (31% of the market) were using one form or another of online banking. Five years later, 47% of Americans were banking online, according to a survey by Gartner Group. Meanwhile, in the UK e-banking grew its reach from 63% to 70% of Internet users between 2011 and 2012.

Regulations

Since its inception, online banking in the US has been federally governed by the Electronic Funds Transfer Act of 1978.

Advantages

There are some advantages on using e-banking both for banks and customers:

- Permanent access to the bank

- Lower transaction costs / general cost reductions

- Access anywhere

Security

Security of a customer's financial information is very important, without which online banking could not operate. Similarly the reputational risks to the banks themselves are important. Financial institutions have set up various security processes to reduce the risk of unauthorized online access to a customer's records, but there is no consistency to the various approaches adopted...

The use of a secure website has become almost universally adopted.

Though single password authentication is still in use, it by itself is not considered secure enough for online banking in some countries. Basically there are two different security methods in use for online banking.

- The PIN/TAN system where the PIN represents a password, used for the login and TANs representing one-time passwords to authenticate transactions. TANs can be distributed in different ways, the most popular one is to send a list of TANs to the online banking user by postal letter. Another way of using TANs is to generate them by need using a security token. These token generated TANs depend on the time and a unique secret, stored in the security token (two-factor authentication or 2FA).

- More advanced TAN generators (chipTAN) also include the transaction data into the TAN generation process after displaying it on their own screen to allow the user to discover man-in-the-middle attacks carried out by trojans trying to secretly manipulate the transaction data in the background of the PC.

- Another way to provide TANs to an online banking user is to send the TAN of the current bank transaction to the user's (GSM) mobile phone via SMS. The SMS text usually quotes the transaction amount and details, the TAN is only valid for a short period of time. Especially in Germany, Austria and The Netherlands, many banks have adopted this "SMS TAN" service.

- Usually online banking with PIN/TAN is done via a web browser using SSL secured connections, so that there is no additional encryption needed.

- Signature based online banking where all transactions are signed and encrypted digitally. The Keys for the signature generation and encryption can be stored on smartcards or any memory medium, depending on the concrete implementation. (see, e.g., the Spanish ID card DNI electrónico)

Attacks

Attacks on online banking used today are based on deceiving the user to steal login data and valid TANs. Two well known examples for those attacks are phishing and pharming. Cross-site scripting and keylogger/Trojan horses can also be used to steal login information.

A method to attack signature based online banking methods is to manipulate the used software in a way, that correct transactions are shown on the screen and faked transactions are signed in the background.

A 2008 U.S. Federal Deposit Insurance Corporation Technology Incident Report, compiled from suspicious activity reports banks file quarterly, lists 536 cases of computer intrusion, with an average loss per incident of $30,000. That adds up to a nearly $16-million loss in the second quarter of 2007. Computer intrusions increased by 150 percent between the first quarter of 2007 and the second. In 80 percent of the cases, the source of the intrusion is unknown but it occurred during online banking, the report states.

Another kind of attack is the so-called Man in the Browser attack, where a Trojan horse permits a remote attacker to modify the destination account number and also the amount.

As a reaction to advanced security processes allowing the user to cross check the transaction data on a secure device there are also combined attacks using malware and social engineering to persuade the user himself to transfer money to the fraudsters on the ground of false claims (like the claim the bank would require a "test transfer" or the claim a company had falsely transferred money to the user's account and he should "send it back"). Users should therefore never perform bank transfers they have not initiated themselves.

Countermeasures

There exist several countermeasures which try to avoid attacks. Digital certificates are used against phishing and pharming, in signature based online banking variants (HBCI/FinTS) the use of "Secoder" card readers is a measurement to uncover software side manipulations of the transaction data. To protect their systems against Trojan horses, users should use virus scanners and be careful with downloaded software or e-mail attachments.

In 2001, the U.S. Federal Financial Institutions Examination Council issued guidance for multifactor authentication (MFA) and then required to be in place by the end of 2006.

In 2012, the European Union Agency for Network and Information Security advised all banks to consider the PC systems of their users being infected by malware by default and therefore use security processes where the user can cross check the transaction data against manipulations like for example (provided the security of the mobile phone holds up) SMS TAN where the transaction data is send along with the TAN number or standalone smartcard readers with an own screen including the transaction data into the TAN generation process while displaying it beforehand to the user (see chipTAN) to counter man-in-the-middle attacks.

See also

- Current account

- Enhanced Telephone, (Citibank product about 1990)

- Guide to E-payments

- Mobile banking

- On-line and off-line

- SMS banking

- Single sign-on

- Telephone banking

References

External links

- Gandy, T. (1995): "Banking in e-space", The banker, 145 (838), pp. 74â€"76.

- Tan, M.; Teo, T. S. (2000): "Factors influencing the adoption of Internet banking", Journal of the Association for Information Systems, 1 (5), pp. 1â€"42.

Exchange Bitcoin to Perfect Money Instantly and easily with Bitcoinscashout.com, Solution for Bitcoin to Perfect money Account Payment system

ReplyDeleteExchange Bitcoin to Perfect Money Account

bankofamericacom/activate

ReplyDeleteGreat post, and great website. Thanks for the information! One Pearl Bank

ReplyDeleteThanks for taking the time to discuss that, I feel strongly about this and so really like getting to know more on this kind of field. Do you mind updating your blog post with additional insight? It should be really useful for all of us. chen zhi prince group

ReplyDeleteI was surfing the Internet for information and came across your blog. I am impressed by the information you have on this blog. It shows how well you understand this subject. prince chenzhi

ReplyDeleteHello I am so delighted I located your blog, I really located you by mistake, while I was watching on google for something else, Anyways I am here now and could just like to say thank for a tremendous post and a all round entertaining website. Please do keep up the great work. prince group cambodia

ReplyDeleteI read that Post and got it fine and informative. chen zhi cambodia

ReplyDelete